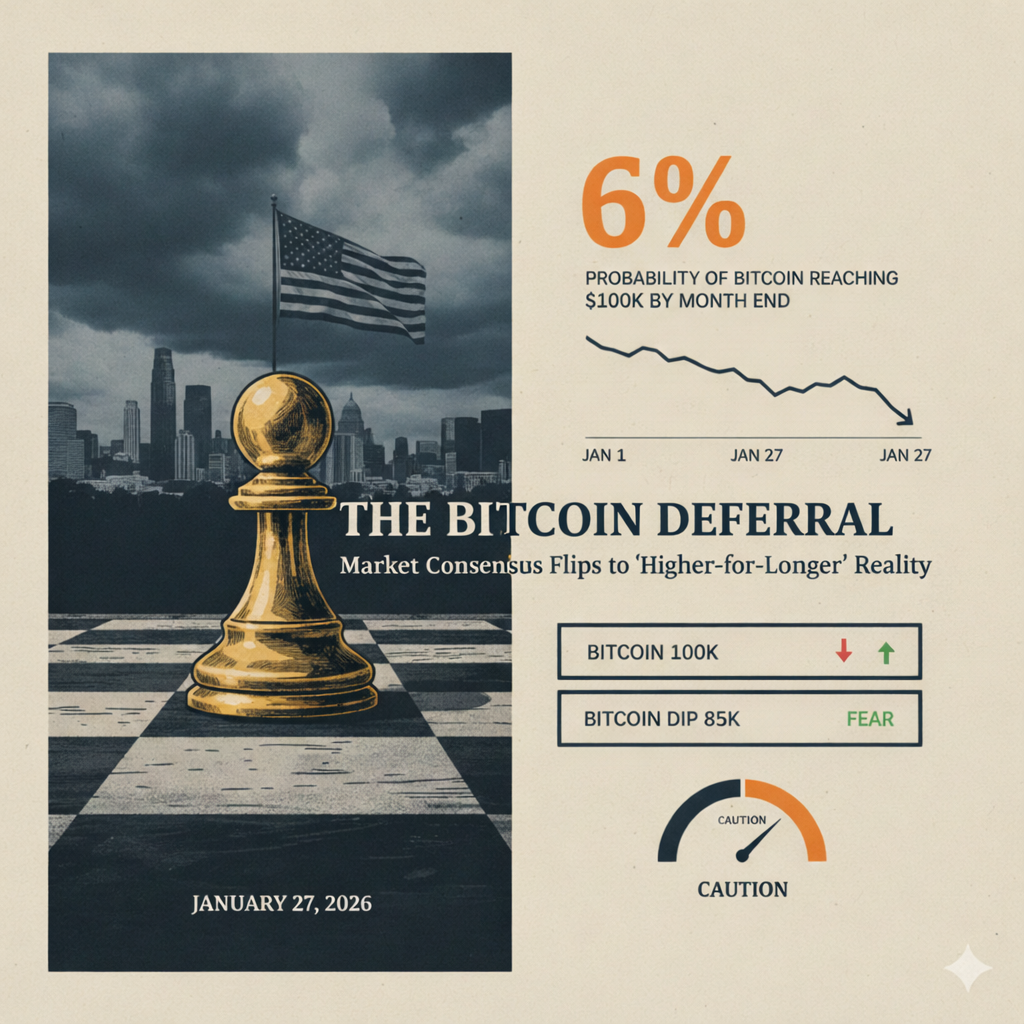

Market Consensus Estimates 6% Probability of Bitcoin Reaching Six Figures by Month End

The collective judgment of global participants has reached a definitive conclusion regarding the immediate trajectory of the largest digital asset. On Polymarket, the decentralized probability of Bitcoin reaching $100,000 before February 1 has collapsed to a mere 6%. This quantified consensus represents a total capitulation of the optimistic sentiment that defined the start of the year. While January opened with a fervent belief that the six-figure milestone was inevitable, the market now signals that the psychological and technical resistance near $100,000 is likely to remain intact for the duration of the winter season.

The Dissolution of the January Breakout Thesis

The rapid decline in probability from a mid-month high of 35% to the current single-digit figure illustrates how quickly skin-in-the-game participants react to changing liquidity conditions. The primary catalyst for this shift was the rejection encountered on January 14. On that day, Bitcoin reached a peak of $97,900, coming within a narrow margin of the hundred-thousand-dollar mark. However, the inability to sustain that level triggered a wave of institutional profit-taking and significant outflows from spot exchange-traded funds. This price action serves as a reminder that the wisdom of crowds is not merely about optimism, but about the cold assessment of capital flows.

The collective intelligence of the market is currently processing several significant headwinds that were not fully priced in during the initial New Year rally. Foremost among these is the shift in expectations regarding the Federal Reserve. Heading into the January 28-29 Federal Open Market Committee meeting, prediction markets have pivoted toward a more cautious outlook. Traders now estimate a 58% probability that the central bank will hold interest rates steady. In an environment where the "higher-for-longer" narrative persists, non-yielding assets such as Bitcoin often lose their luster as the cost of capital remains elevated.

Furthermore, the ongoing uncertainty surrounding the United States government shutdown has introduced a level of political volatility that appears to favor traditional safe havens over digital ones. While Bitcoin proponents often argue that the asset serves as digital gold, the actual behavior of the market suggests a different preference in the current crisis. Gold recently surpassed $5,000 per ounce, and the flow of capital toward bullion indicates that, in the eyes of the market, the yellow metal remains the premier hedge against legislative instability and federal funding failures.

Implied Probability and the Defensive Ceiling

The structure of the prediction market contracts provides a clear map of where the largest players are positioned. On platforms like Kalshi and Polymarket, high-volume participants have effectively defended the $90,000 to $95,000 range. The 6% market-implied probability for a $100,000 close is not an arbitrary number. It represents the aggregate view of thousands of traders who are betting that retail demand lacks the necessary momentum to overcome the wall of institutional sell orders currently stacked above the $90,000 level.

When observing the current predictability numbers for the next 90 to 180 days, a distinct pattern emerges. While the immediate January outlook is bleak, the market is not entirely bearish on the long-term prospects of the asset. The contract for Bitcoin reaching $100,000 by June currently carries a 65% probability. This suggests that the crowd views the current stagnation as a temporary consolidation rather than a terminal peak. The divergence between the 6% short-term probability and the 65% mid-term probability indicates that the market expects a period of "sideways-to-down" price action until the macro-economic picture becomes clearer.

The liquidity trap currently being observed is a function of "No" bettors successfully maintaining their positions. On Kalshi, the probability of Bitcoin dropping below $85,000 has risen to 44%, an 18% increase over the past week. This suggests that the center of gravity for the market is shifting downward. The crowd is moving away from the "moon mission" narrative and toward a defensive posture, prioritizing capital preservation as the federal shutdown looms and the interest rate environment remains restrictive.

Historical Precedent and the Wisdom of Decentralized Groups

The current market behavior mirrors previous instances where a major psychological barrier became a magnet for volatility before a meaningful breakout could occur. In financial history, round numbers often act as significant hurdles because they represent a convergence of technical orders and human emotion. The wisdom of crowds is particularly effective at identifying these points of exhaustion. By aggregating the bets of participants with varying degrees of information, prediction markets filter out the noise of social media hype and focus on the actual commitment of resources.

In this instance, the crowd is recognizing that the catalyst for a $100,000 Bitcoin—namely, a dovish pivot by the Federal Reserve and a surge in institutional adoption—has been delayed. The 6% probability is a reflection of the reality that there is no immediate fundamental driver strong enough to push the price through the massive supply of Bitcoin available at the $98,000 mark. History suggests that when a market approaches such a significant level and fails to break it on the first few attempts, a period of cooling is necessary to wash out over-leveraged participants. This is exactly what the current probability of 6% is signaling.

The efficiency of these markets lies in their ability to incorporate new information faster than traditional polling or expert commentary. As news of the potential government shutdown intensified, the odds of a January breakout began to tumble in real-time. This adjustment happened well before many financial news outlets began to question the $100,000 target. This underscores the value of prediction markets as a forward-looking signal: they do not tell us what people think will happen, they tell us what people are willing to pay for a specific outcome.

Analysis of the Two Potential Paths

As the month draws to a close, the market is weighing two distinct future paths with systemic implications for the broader digital asset ecosystem. In the first scenario, a majority outcome consistent with the current 6% probability, Bitcoin fails to breach $90,000 and continues to trend toward the $80,000 support level. The implications of this path are significant. It would likely lead to a broader "de-risking" across all digital assets, as the failure of the flagship currency to hold its gains would sap confidence from smaller, more speculative tokens. This would confirm that the January rally was a "trap" for late-arriving retail investors and would necessitate a several-month period of accumulation before another attempt at $100,000 could be made.

In the second, minority scenario, a sudden and unforeseen "dovish surprise" from the Federal Reserve or an immediate resolution to the federal funding crisis could trigger a short-squeeze. If Bitcoin were to break above $92,500 in the final days of the month, the 6% "lottery ticket" contracts would see an explosive increase in value as traders rushed to cover their short positions. However, the market currently views this as a low-probability event. The systemic impact of such a move would be a rapid re-rating of all risk assets, but the collective weight of the money is currently betting against this outcome. The crowd is effectively saying that the obstacles to growth are too numerous to be cleared in such a short window of time.

The tension between these two paths is what drives the current volatility. Institutional participants are heavily bidding on downside protection, with contracts for a drop to $85,000 seeing increased activity. This suggests that the professional class is more concerned with hedging against a deeper correction than they are with missing out on a late-month rally. The market's "truth signal" is therefore skewed toward caution, emphasizing that the path of least resistance is lower until the geopolitical and monetary clouds disperse.

Conclusion on Market Efficiency and the Value Gap

The current probability of 6% suggests that the market has almost entirely priced out the possibility of a January milestone. This indicates a high level of market efficiency, as the odds have moved in lockstep with deteriorating macro-economic conditions. There appears to be very little "lag" in the crowd's assessment; the rejection at $97,900 was digested almost instantly and reflected in the falling prices of "Yes" contracts.

For those looking for a value gap, the current focus should shift away from the expiring January contracts, where time-decay is now the primary driver of price. The real value may lie in the mid-term markets. While the January target has failed, the 65% probability for a June breakout suggests a strong underlying belief in the asset's long-term trajectory. Conversely, the market for an $80,000 floor in the first quarter is currently priced at 30% on Polymarket. If Bitcoin fails to hold the $86,000 level in the coming days, this specific contract could see a rapid appreciation as the market adjusts to a new, lower range. The wisdom of the crowd is clear: the dream of a six-figure Bitcoin has not been canceled, but it has certainly been deferred.

This analysis of market probability does not constitute financial advice.