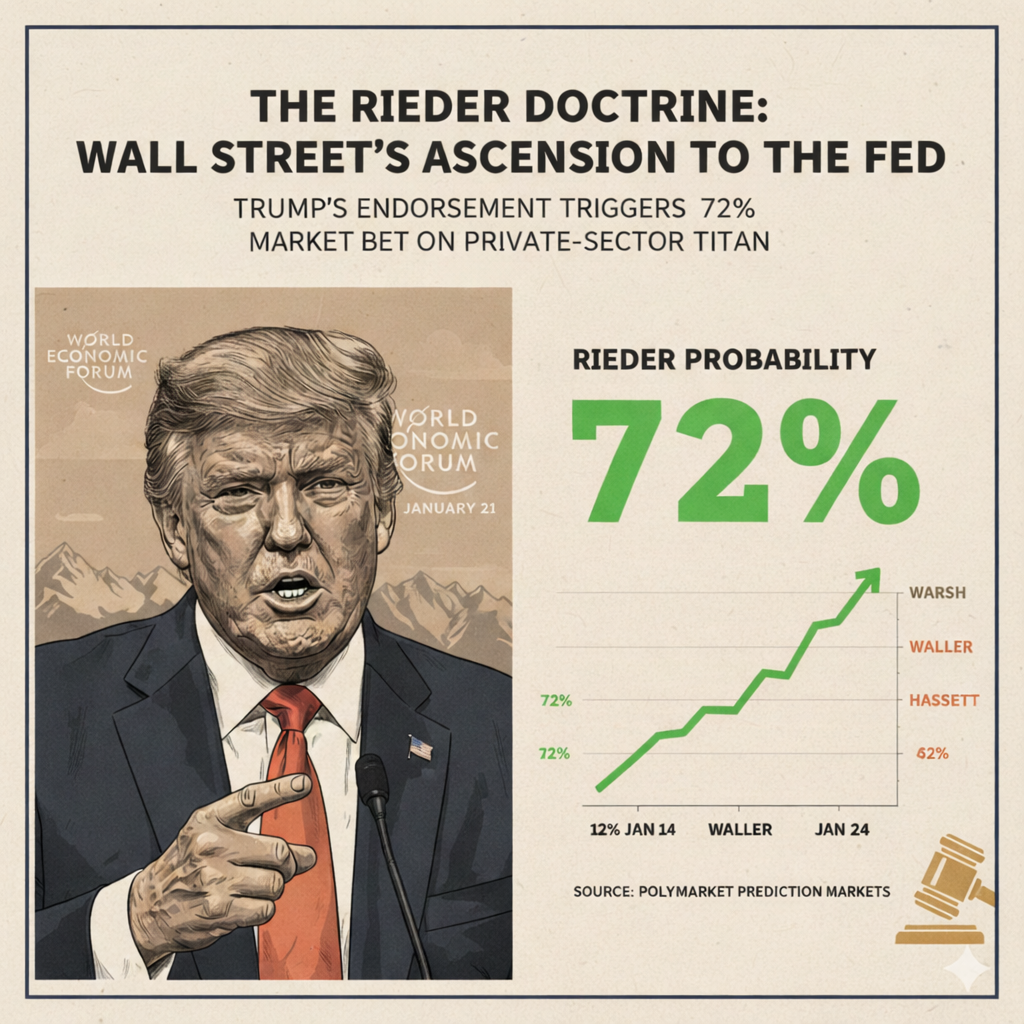

Prediction Markets Assign 72% Probability to Rick Rieder as Next Federal Reserve Chair Following Trump Endorsement

The quantified consensus surrounding the leadership of the Federal Reserve underwent a violent recalibration this week, as prediction markets moved to price in a new frontrunner for the world's most influential economic post. Market participants on Polymarket now assign a 72% probability to Rick Rieder, BlackRock’s Chief Investment Officer of Global Fixed Income, becoming the next Chair of the Federal Reserve. This surge represents a dramatic departure from the previous week's data, which favored traditional institutionalists. The catalyst for this realignment was not a shift in economic data or inflationary trends, but a direct verbal intervention by President Donald Trump during the World Economic Forum in Davos. By describing Rieder as "very impressive" and "very good" during a high-profile CNBC interview on January 21, the President effectively signaled a pivot in his selection process, prompting the "Wisdom of Crowds" to rapidly discount the chances of former favorites in favor of a private-sector titan.

The Davos Catalyst and the Erosion of the Hassett Thesis

The abruptness of Rieder's ascent highlights the efficiency with which decentralized betting markets aggregate political signaling into a singular, tradable probability. Prior to the Davos summit, the race to succeed Jerome Powell, whose term expires in May 2026, was largely viewed as a contest between Kevin Warsh and Kevin Hassett. Hassett, a loyal economic advisor to the Trump administration, held the position of favorite for much of the late fourth quarter. However, the market-implied probability of a Hassett chairmanship cratered from nearly 60% to under 10% in a matter of hours after the President explicitly stated his preference to retain Hassett in his current capacity at the National Economic Council.

This development underscores a fundamental tenet of prediction markets: participants with skin in the game are less concerned with partisan loyalty than they are with the mechanical reality of executive appointments. When the President clarified his personnel strategy on a global stage, the crowd immediately reallocated capital. The vacuum left by Hassett's exit was not filled by the established runner-up, Kevin Warsh, but rather by Rieder, who represents a significant departure from the academic and bureaucratic norms of central banking.

The history of Federal Reserve appointments has typically favored a predictable trajectory of legal or academic expertise. Rieder, by contrast, is a career bond trader. His rise to a 72% market-implied probability suggests that the "crowd" believes the next administration is seeking a practitioner rather than a theorist. As the manager of trillions in fixed-income assets, Rieder’s professional life has been defined by the real-time observation of interest rate fluctuations and liquidity constraints. The market's thesis is that a Trump administration seeks a Fed Chair who views the economy through the lens of a balance sheet, prioritizing market functionality and "creative" liquidity measures over the traditional adherence to the Taylor Rule or other rigid econometric models.

Deciphering the 72% Predictability Number

In the parlance of decentralized finance, a "72-cent contract" on Rick Rieder is more than a wager; it is a real-time assessment of political inevitability. This predictability number tells us that over the next three to six months, the financial world expects a transition away from "forward guidance" as it has been practiced by Jerome Powell and toward a more transactional, market-responsive monetary policy.

When a candidate crosses the 70% threshold on platforms like Polymarket or Kalshi, it generally indicates that the market no longer views the event as a "toss-up" but as a baseline expectation. For the broader economy, this implies that the "Rieder Doctrine" is already being factored into long-term yields. Rieder has been a vocal proponent of addressing the housing crisis through targeted monetary intervention, even suggesting that the Fed should find ways to lower mortgage rates specifically, rather than relying solely on the blunt instrument of the federal funds rate. The market is currently pricing in the possibility of a Federal Reserve that acts more like a "Market Maker" than a "Lender of Last Resort," potentially using the central bank's balance sheet to support specific sectors of the credit market.

This 72% probability also reflects a total collapse in the odds for Governor Christopher Waller and former Governor Kevin Warsh. Warsh, who for months was seen as the safe, institutional choice with a 35% probability, has seen his "shares" decline as the administration’s preference for an outsider became clear. The Wisdom of Crowds is signaling that the era of the "Fed Insider" may be coming to an end, replaced by a leadership style that mirrors the President's own preference for private-sector experience and unconventional problem-solving.

The Divergent Paths of Monetary Policy

As the market weighs this 72% probability, it is simultaneously evaluating two distinct future paths for the American economy. The majority outcome, as signaled by the crowd, is a Rieder-led Fed that would likely pursue "experimental" monetary policy. In this scenario, the systemic implications are profound. A Fed Chair who is willing to target mortgage rates directly or employ Yield Curve Control (YCC) would represent the most significant shift in central banking since the Volcker era. For investors, this path suggests a more bullish environment for housing and Treasuries, as Rieder’s "bond guy" perspective would likely prioritize market liquidity and the prevention of "disorderly" moves in the credit markets. However, this path is fraught with political risk; as a career executive at BlackRock, Rieder would face an intense confirmation process regarding potential conflicts of interest and the perceived "financialization" of the Fed.

Conversely, the minority outcome—the 28% chance that the market is currently misjudging the situation—rests on the return to an institutionalist like Kevin Warsh or an internal candidate like Christopher Waller. In this scenario, the Fed would likely maintain a more traditional, rules-based approach to inflation and interest rates. A Warsh chairmanship would be perceived as a victory for "sound money" advocates who remain wary of the Fed’s expanding balance sheet. While this path offers more stability and a smoother Senate confirmation, it lacks the aggressive, market-driven reform that the Trump administration appears to be seeking. The market currently views this as a hedge rather than a primary expectation, suggesting that the "Institutionalist" path is losing its grip on the collective imagination of the investing public.

The tension between these two outcomes explains the recent volatility in the prediction markets. If Rieder's ties to the private sector begin to draw significant fire from the Senate Banking Committee, the probability may shift back toward Waller or Warsh. Yet, the crowd remains focused on the President's public endorsement as the ultimate lead indicator. In the world of prediction markets, the "Truth Layer" is built on the belief that what a leader says to a global audience is a more reliable predictor of future action than the institutional inertia of the status quo.

Historical Context and the Evolution of the "Skin in the Game" Signal

To understand why a 72% probability for a BlackRock executive is so significant, one must look at the history of the Federal Reserve’s relationship with Wall Street. Since the 1951 Treasury-Fed Accord, the central bank has fought to maintain its independence from both the executive branch and the immediate whims of the financial markets. The rise of Rick Rieder, as predicted by the decentralized crowd, suggests a potential merging of these spheres.

Prediction markets have a history of outperforming traditional pundits in these scenarios because they account for "the quiet information." While cable news analysts may focus on the difficulty of a BlackRock executive getting confirmed, the market looks at the administrative staff being assembled and the rhetoric being used in private donor circles. The move from 12% to 72% in a single week is a statistical manifestation of that "quiet information" becoming public. It mirrors previous market shifts, such as the 2016 election night where prediction markets famously flipped hours before traditional news outlets were willing to call the result. In the current context, the market is telling us that the "unthinkable" choice of a private-sector bond trader is now the most "probable" reality.

The global implications of this shift are immense. A Fed Chair who views the federal funds rate through the prism of a global macro trader would fundamentally change how the "carry trade" and international currency markets operate. If the crowd is correct, the next four years will see a Federal Reserve that is more transparently aligned with the health of the financial markets than at any point in its history. This is why the volume on these contracts has surged; traders are not just betting on a person, they are betting on the future architecture of the global financial system.

Market Outlook: The Value Gap and Institutional Lag

As we assess the current 72% market-implied probability, the central question for the analytical observer is whether this movement is "fully priced in" or if the crowd is lagging behind a new catalyst. The sudden 40-point swing in Rieder’s favor suggests that the market has processed the Davos endorsement with high efficiency. However, a "Value Gap" may still exist in the 12% probability assigned to Christopher Waller. If the Senate's scrutiny of Rieder’s BlackRock tenure proves to be an insurmountable hurdle, the administration may be forced to pivot to a "safe" internal candidate to ensure a seamless transition when Powell’s term concludes.

The wisdom of the crowd is currently betting that the President’s personal preference will override traditional vetting obstacles. This is a high-conviction stance that assumes the political capital of the administration is at its peak. If the probability continues to hold above 70% as we approach the summer, it will signal that the "Rieder Doctrine" has moved from a speculative bet to a fundamental market assumption.

The current consensus reflects a market that has abandoned the "Institutionalist" thesis in favor of a "Disruptor" thesis. Whether this represents a permanent shift in the Federal Reserve's DNA or a temporary deviation remains to be seen, but for now, the decentralized group with "skin in the game" has made its voice clear. The lead is no longer Warsh's to lose; it is Rieder’s to maintain. The market is not just predicting a person; it is predicting a paradigm shift.

This analysis of market probability does not constitute financial advice.