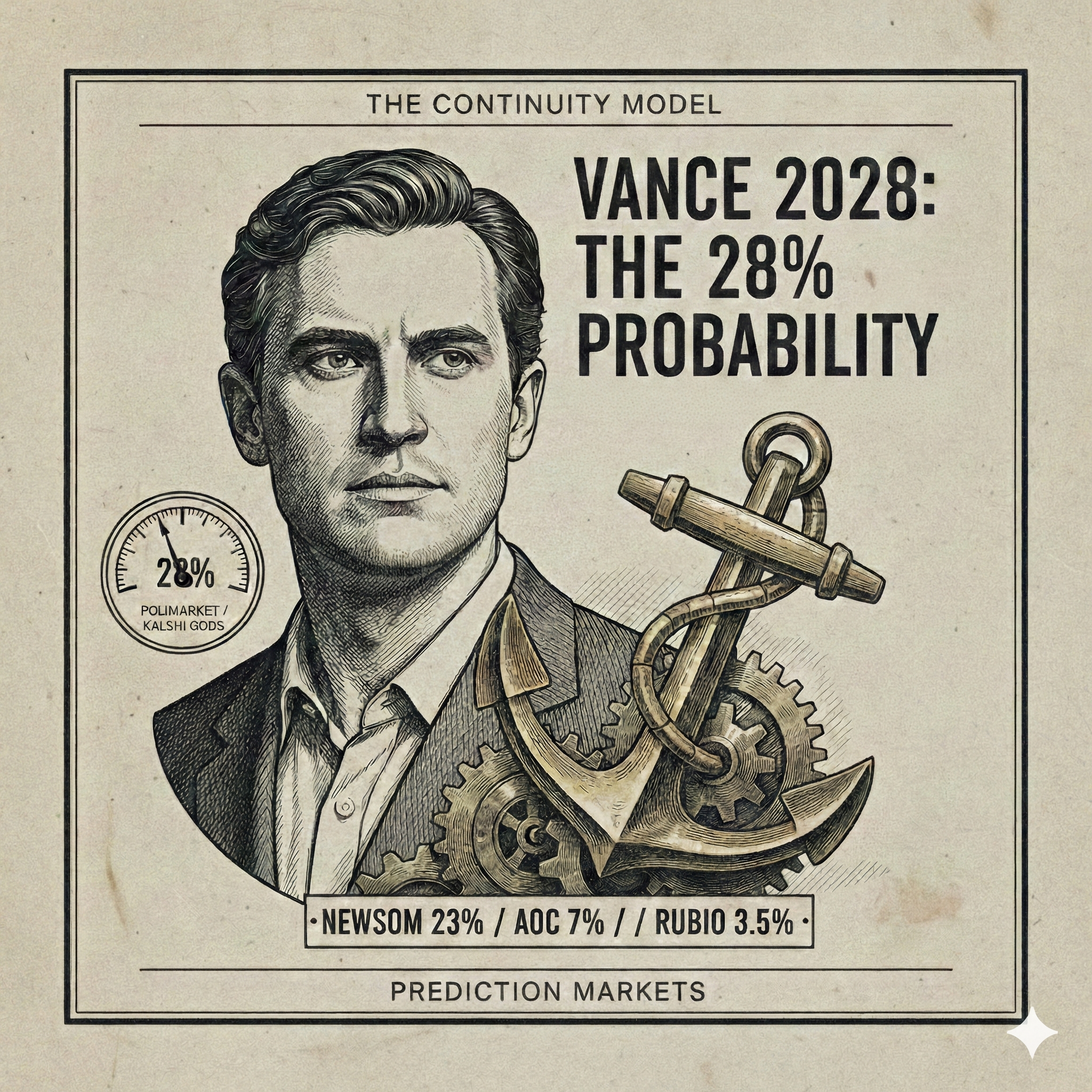

Market Consensus Signals 28% Probability of J.D. Vance Victory in 2028 Presidential Election

The earliest quantified consensus for the 2028 U.S. Presidential Election has begun to coalesce around a definitive frontrunner, as prediction markets move to price in the longevity of the current administration’s policy platform. Market participants on Polymarket and Kalshi currently assign a 28% probability to Vice President J.D. Vance winning the presidency in 2028. This 28-cent "Yes" contract places Vance in a narrow but consistent lead over his primary rival, California Governor Gavin Newsom, who holds a 23% market-implied probability. Despite the election remaining nearly three years away, the "Succession" market has already emerged as one of the most liquid political contracts on the board, driven by high-net-worth quants who view the current administration’s early 2026 performance as a primary indicator of future electoral durability.

The Heir Apparent and the Strategy of Base Consolidation

The crowd’s thesis regarding Vance’s 28% probability is rooted in the perceived consolidation of the Republican base. Unlike the Democratic field, which remains fragmented among several high-profile contenders, the "Wisdom of Crowds" suggests that the Republican party has largely settled on Vance as the natural successor to the current executive framework. This "Predictability Number" is bolstered by Vance’s active role in the 2026 midterm strategy, where he has been tasked with defending the administration’s trade and deregulation agenda.

Traders are effectively betting that Vance’s position as the "heir apparent" provides him with an institutional advantage that outweighs the historical volatility of early-cycle polling. On platforms like Polymarket, the 28% figure reflects a "Whale" market where single trades exceeding $100,000 are increasingly common. This indicates that the price is being set by participants with a high degree of conviction in the "continuity" narrative. Conversely, the 23% probability assigned to Gavin Newsom reflects a market that views the California Governor as the most viable "pendulum swing" candidate, though his odds remain capped by a Democratic field that still features Alexandria Ocasio-Cortez at 7% and Secretary of State Marco Rubio at 3.5% on the Republican side.

The market-implied probability suggests that participants view 2028 not as a traditional "open" election, but as a referendum on the 2025-2026 policy era. If the administration’s economic interventions—particularly in the aerospace and technology sectors—continue to yield perceived results, the crowd believes Vance will remain the prohibitive favorite.

Dual-Outcome Analysis: The Continuity Model vs. The Pendulum Swing

As the 28% probability establishes a baseline for the 2028 cycle, market participants are weighing two distinct future paths for the American political landscape.

Scenario A: The Vance Continuity Model (28% Probability) If J.D. Vance maintains his position above the 25% threshold throughout 2026, it will signal to the market that the current "MAGA" policy era has long-term staying power. Systemically, this would lead to a more predictable environment for domestic manufacturing and defense sectors, as corporations price in a twelve-year horizon for current trade policies. For investors, a Vance victory represents the institutionalization of the current administration’s "Market Maker" approach to the economy.

Scenario B: The Newsom Pendulum Swing (23% Probability) In the minority outcome, a surge in Newsom’s probability would indicate that the market sees a corrective "pendulum swing" coming in response to 2026 economic conditions. If the Liberation Day tariffs or current Fed leadership strategies trigger a significant market contraction, Newsom’s "shares" would likely skyrocket as the crowd moves to hedge against the incumbent party. This path would introduce significant volatility into the currency and international trade markets as participants begin to price in a return to traditional multilateralism.

Market Outlook: The Incumbency Premium

At 28%, J.D. Vance currently holds the highest "incumbent-successor" rating in the history of prediction markets at this distance from an election. The market is effectively predicting a "Vance vs. Newsom" showdown as the default future, treating other potential candidates as statistical noise. However, the true "future-telling" signal will likely emerge after the 2026 midterms. If the Republican party maintains its grip on the House and Senate, Vance’s probability is expected to cross the 35% mark, signaling a level of electoral inevitability rarely seen in modern politics. For now, the crowd is waiting to see if the 2026 economic data supports the 28% conviction or if the "Value Gap" lies with the Democratic challengers.

This analysis of market probability does not constitute financial advice.