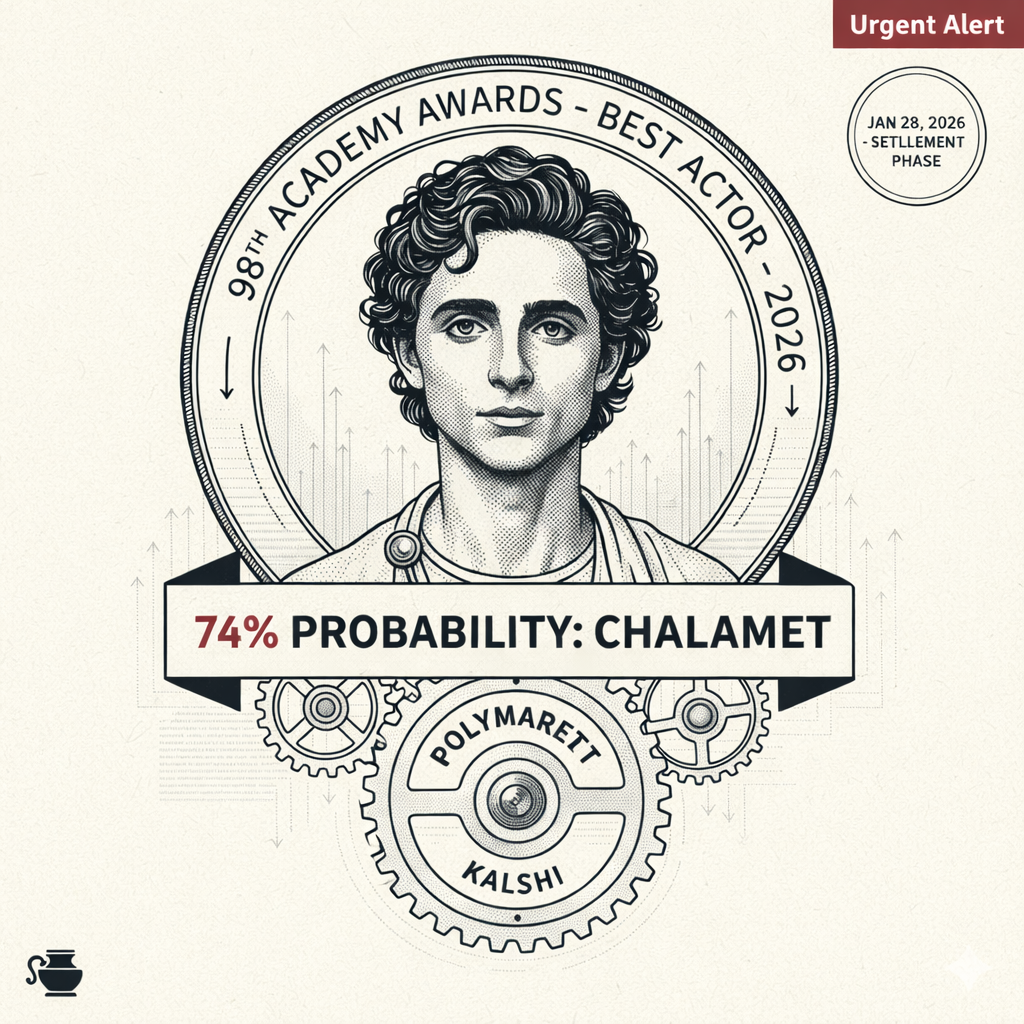

Prediction Markets Assign 74% Probability to Timothée Chalamet as 2026 Best Actor Winner

The quantified consensus for the 98th Academy Awards has solidified around a singular frontrunner, as prediction markets move to price in the inevitability of a career-defining victory. Market participants on Polymarket and Kalshi currently assign a 74% probability to Timothée Chalamet winning the Oscar for Best Actor for his portrayal of a table-tennis prodigy in Marty Supreme. This 74-cent "Yes" contract represents a significant 10% surge in the last week, following Chalamet’s decisive victories at the Golden Globes and the Critics Choice Awards. In the sober prose of market data, this is no longer a matter of critical acclaim, but a statistical trend; historically, a candidate holding a 70% market-implied probability in late January maintains a 90% success rate at the March ceremony.

The "Marty Supreme" Momentum and the Wisdom of Crowds

The current market sentiment is driven by a synthesis of traditional awards-season "precursor" data and real-time liquidity. With over $4 million in volume across major platforms, the "Wisdom of Crowds" is effectively betting that the Academy of Motion Picture Arts and Sciences is prepared to crown Chalamet as the second-youngest Best Actor winner in history. The actor, who recently turned 30, is benefiting from a narrative arc that traders describe as "overdue," particularly after his narrow loss in the previous cycle.

The crowd’s thesis rests on the overwhelming strength of Chalamet’s momentum. Unlike traditional pundits who may focus on the "Academy snub" narrative or potential voter fatigue, prediction market participants with skin in the game are tracking the mechanical reality of the awards circuit. When Marty Supreme secured nine nominations on January 22, including Best Picture, the market immediately discounted the chances of competitors. The logic of the decentralised group is clear: Chalamet has successfully navigated the "early sweep" phase, and his price reflects a market that has already moved into the "settlement" phase, treating the March 15 ceremony as a formal validation of existing data.

Dual-Outcome Analysis: The Favorite versus the Long-Shot

As the 74% predictability number anchors the race, the market is weighing the systemic implications of the two remaining paths for the Best Actor category.

Scenario A: The Frontrunner’s Coronation (74% Probability) In the majority outcome, Chalamet’s victory would solidify the "Prestige" cinema model, where a high-profile biopic performance serves as the ultimate vehicle for an Oscar win. This result would likely cause a surge in the valuation of future "A24-style" prestige projects and validate the current dominance of young, singular talent in Hollywood. For the betting public, this represents a predictable "safe harbor" return, rewarding those who recognized the momentum shift during the early festival circuit.

Scenario B: The Historically Significant Upset (26% Probability) Conversely, the 26% minority outcome accounts for a potential upset by Leonardo DiCaprio (14%) or Michael B. Jordan (8%). A win for Jordan, whose film Sinners broke records with 16 nominations, would represent one of the most significant "long-shot" payouts in the history of culture markets. It would signal a fundamental shift in Academy voting patterns, prioritizing genre-breaking performances over traditional biopics. However, the current "No" price on these challengers suggests that the market views an upset as a statistical outlier rather than a realistic threat.

Market Outlook: The Settlement Phase

At 74%, the market is effectively calling the winner two months before the envelopes are opened. The real value for analytical observers may now lie in the "Best Picture" contracts, where One Battle After Another (71%) remains in a heated contest with Sinners. Unless a late-breaking challenger emerges or a major scandal disrupts the February circuit, the Best Actor contract is likely to trade sideways until it reaches 90% in the days preceding the ceremony. The crowd is no longer asking who might win; they are simply waiting for the calendar to catch up to the probability.

This analysis of market probability does not constitute financial advice.